이미지 텍스트 확인

9월 외국인 수급

*자료 ! 신업녹심자 인부, 미래예셋습신 리서지센다

0125.10.,1

억대

9월 반도체 수출은 역대 최대인 166억 달러전년 대비 +22%)

최대 행진

반도체 견인 속 9월 수출 전년대비 12.7% 증가한 $659.5억 기록

반도체 수출액 및 전체 수출에서 차지하는 비중

(어달러)

한국 수술: 반도체

비중(무)

C)

180

30

160

25

140

120

’20

100

15

80

60

10

40

5

20

10

71

12

13

174

15

16

17

18

19

20

21

22

23

24

25

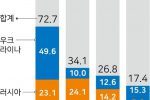

곧 30% 찍을듯

한번도 경험해보지 않은 역대급 메모리반도체 슈퍼사이클이 오고 있음

2028년까지 장기 호황 전망

그 보수적인 노무라 증권도 하이닉스 목표주가 54만원 삼성전자 12만 3000원 부르고 있음

두기업의 내년 영업이익 120~130조원대 전망 내후년은 140~150조원대 ㄷㄷㄷ

이미지 텍스트 확인

NOAIURA

Global Markets Research

Global memory

24 September 2025

EQUlTy: MEMORY

Unprecedented super-cycle

Research Analysts

Asia Pacific Technology

DRAM, HBM, and NAND triple super-cycle in 2026F

CW Chung

NIHK

cwchung@nomura com

+852 2252 6075

US Big Tech’s investments in both Al and conventional servers to boost 2026F memnory

Eon Hwang

NFIK

demand; commodity DRAMINAND OPM to reach historical high in 2026F

eon hwang@nomura com

There had been market concerns that comnpetition amnong DRAM players in the HBM market

+822 3783 2318

would intensify from 2026

as Samsung (005930 KS Buy) is likely to come back to Nvidia’s

Heesoo Min

NFIK

(NVDA US Not rated) HBM marketin 2026. On the flip side the demand for conventional server

heesoo min@nomura com

DRAM SSDs, and other products was expected to recover thanks to the recovery Of traditional

+822 3783 2333

server demand. Following OpenAl’s (unlisted) launch of ChatGPTin 2022, US Big Tech

companies have established longer-term plans to expand their capex and additional data center

shells

which typically take over two years to construct

are

expected toincrease significantly

from mid-2025 to 2026,in our view. However, the strength of the demand recovery appears to

significantly exceed our earlier expectations made in late July (Samsung , Hynix report)

While Big Tech companies have been rapidly expanding their Al server investments, traditional

server investments declined by 3096 y-y in 2023 and only began expanding this year by c.1596,

and will increase by 20-3096 in 2026F,in our view Consequently; we expect demand for

traditional server-related memory such as DDR4 and DDR5 to grow by around 509 in 2026F

while we project demand for enterprise SSDs (eSSD) used in both Al and traditional servers to

nearly doublein 2026F. We expect eSSD demand which accounts for approximately 4096 of

total NAND demand, to grow by over 10096 next year, partly due to strong storage demand from

both traditional and Al data centers and partly due toalack of HDD supply in 2026F, leading to

overall NAND bit demand y-y growth of at least 5096. As a result shipment forecasts are

revised upward, inventory levels should rapidly decline, and we expect price increases to OCCur

faster than we had previously anticipated Overall, we expect the memory industry’s capital

expenditure growth to accelerate beyond our previous forecasts.

OPM for commodity DRAM, currently at 40-5096, appears capable Of recovering to levels

approaching its previous peak of 7096 (in 2017) by 2026F We expect NAND operating margins

currently at break-even levels, to entera boom phase; with margins of 30-4096 by 2026FHBM

has seen operating proffit margins polarized between 3096 and 7096 among manufacturers this

year However Samsung’s entry into the HBM3E 12hi and HBMA 12hi markets could narrow this

margin gap to 45-6596,in our view. Nevertheless

we still

anticipate ultra-high profitability

exceeding the DRAM industry s historical average.

Memory market to experience an unprecedented super-cycle; raise TPs for Samsung and

Hynix to KRW123,000 and KRW54O,000, respectively

being